The latest quarterly regulatory filings from some of the leading U.S. credit card issuers reveal that outstandings held by cardholders with higher FICO scores are accounting for an increasing share of total credit card portfolios. Over the past year, there has been ample evidence of issuers targeting more affluent consumers with new products and aggressive offers, while continuing to maintain high underwriting standards.

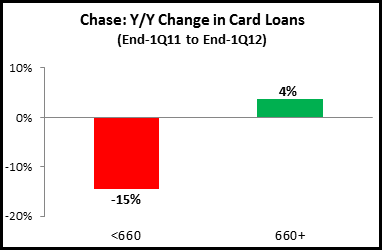

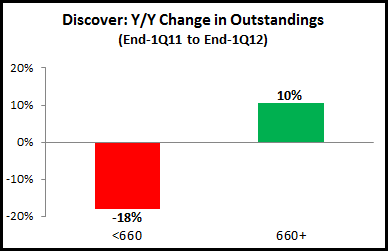

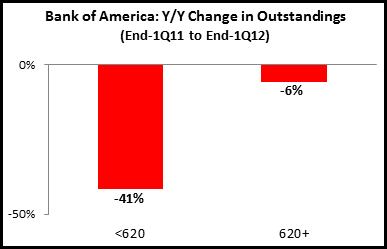

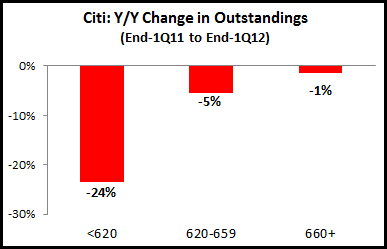

Although these issuers do not use the same FICO-score categories, the following charts show that all issuers reported continued declines in outstandings held by cardholders with lower FICOs (below 660), while oustandings for cardholders with higher FICOs either had smaller declines or in fact grew over the past year.

- Chase: Overall, there was no change in Chase end-of-period (EOP) credit card outstandings between 1Q11 and 1Q12. However, cardholders with FICOs of 660+ (which accounted for 82% of total outstandings in 1Q12) rose 4%, while outstandings with FICOs below 660 fell by 15%.

- Discover uses the same FICO categorization as Chase. It reported a 4% total rise in EOP card outstandings between 1Q11 and 1Q12. FICOs of 660+ rose 10%, while FICOs <660 fell 18%. FICOs of 660+ accounted for 81% of total Discover credit card outstandings at the end of 1Q12, just below the rate for Chase.

- Bank of America uses different FICO categories, with a cut-off point at 620. Total outstandings fell 10% y/y to the end of 1Q12, but the decline in FICOs below 620 (-41%) was much higher than that for FICOs of 620+ (-6%). FICOs of 620+ now account for 92% of total outstandings, compared to 88% in 1Q11.

- Like Bank of America, Citibank’s total EOP U.S. credit card outstandings fell y/y (by 4%), and there were declines in all FICO categories, but again higher FICOs reported lower declines. At Citi, FICOs of 620+ now represent 91% of total outstandings, up from 85% at the end of 1Q11.

- Unlike other issuers, Wells Fargo provides a wide range of FICO categories, which have been summarized into three categories below. Total Wells Fargo credit card outstandings rose 4% y/y, but there was an 11% decline among sub-prime FICOs below 600. For FICOs of 760+, outstandings rose 16% and now represent 25% of outstandings, up from 23% in 1Q11.